The life of a graduate student in 2026 is a balancing act that would make a tightrope walker nervous. If you are pursuing an MBA or grinding through a PhD, you aren’t just a student; you are a project manager, a researcher, and a CFO of your own tiny, often struggling, financial empire. Between tracking down obscure library archives and trying to figure out why your research budget is vanishing faster than a free coffee at a seminar, the stress is real. Most of us start our semester with a “survival kit” that consists of nothing more than a high-end laptop and a lot of hope. But in a world where digital security and financial agility are the new currency, that isn’t enough anymore.

Managing your money while you manage your mind is the biggest hurdle of the modern degree. This is where the intersection of education and finance—or “Ed-Fin”—comes into play. To stay afloat, you need to look beyond standard bank accounts. Whether you are paying for an assignment writing service or subscribing to global research databases, how you pay is just as important as what you pay. Using a brand like myassignmenthelp allows you to delegate the heavy lifting of formatting and data entry, but without the right fintech tools in your kit, even the best academic support can become a security headache.

Why Every Researcher Needs a “Financial Firewall”

When you are deep in a PhD, you end up subscribing to dozens of niche services. You might need a specific data visualization tool for three months, or access to a European archive that only takes specific payment types. Using your primary debit card for these one-off international transactions is like leaving your front door unlocked in a crowded city. It’s not just about the money; it’s about the identity theft risk that can derail your entire semester.

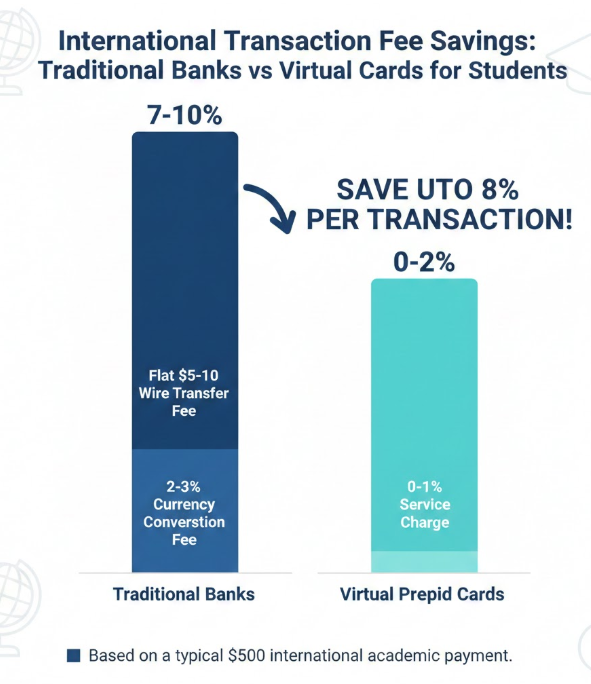

Virtual prepaid cards have become the unsung heroes of the 2026 student experience. These aren’t just “digital versions” of your plastic cards; they are disposable, programmable financial firewalls. You can generate a card for a single use, set a strict spending limit, and “burn” it the moment the transaction is done. This is particularly useful for international students who deal with fluctuating exchange rates and high foreign transaction fees. By loading a virtual card with exactly what you need, you bypass the hidden fees of traditional banks and keep your main tuition funds invisible to the open web.

The Productivity Tech Stack for MBA Leaders

For MBA candidates, the challenge is different. It’s less about long-term data gathering and more about rapid-fire execution and networking. Your survival kit needs to include tools that help you move as fast as the markets do. We are seeing a massive shift toward “Agentic Commerce”—where AI-powered financial apps don’t just track your spending but actually negotiate better rates for your subscriptions or alert you when a better student loan refinancing deal hits the market.

In the middle of a high-stakes semester, you might find yourself needing specialized MBA Assignment Help to manage your workload. It is during these crunch times—right before the 4th heading of your project timeline—that having a streamlined payment and productivity system pays off. When you use myassignmenthelp to get a handle on a complex case study, having a pre-allocated budget on a virtual card ensures you aren’t overspending in a moment of academic panic. It keeps your finances as organized as your bibliography.

The Rise of “Techidemics”: Where Science Meets Finance

There is a new term floating around campus: Techidemics. It refers to the seamless blend of technology and academics that allows a student in London to collaborate with a lab in Tokyo while paying for specialized research tools in USD. To thrive in this environment, your kit must include more than just a calculator. You need tools that handle multi-currency wallets and provide instant AVS (Address Verification Service) checks so you don’t get blocked by international payment gateways.

1. The Power of Programmable Spending

The most advanced fintech tools in 2026 allow you to set “rules” for your money. Imagine a card that only works at bookstores or for academic subscriptions. If someone steals the card number, they can’t go on a shopping spree at an electronics store because the card is “locked” to a specific category. For a PhD student managing a research grant, this level of granularity is a lifesaver. It automates the bookkeeping that used to take up hours of precious study time.

2. Beyond the Spreadsheet: Real-Time Budgeting

We’ve all tried the “spreadsheet method” for budgeting, and we’ve all failed by week three. Modern fintech apps now use “transactional tagging.” Every time you buy a coffee or pay for a proofreading service, the app automatically categories it. By the end of the month, you get a visual map of where your money went. This isn’t just about saving pennies; it’s about seeing if your spending aligns with your goals. Are you spending more on “convenience” (fast food) than on “growth” (books and courses)?

3. Digital Identity and Privacy

Your survival kit isn’t complete without a way to protect your digital footprint. In 2026, your “student identity” is a valuable target for hackers. Fintech tools that offer “masked” emails and phone numbers for your financial accounts add an extra layer of protection. When you sign up for a new research platform, you don’t give them your real info; you give them a “proxy.” This keeps your inbox clean and your personal life private.

4. Collaboration Tools That Pay

Group projects are the bane of every MBA student’s existence, especially when it comes to shared costs. Whether it’s splitting the bill for a premium Zoom account or a shared data set, chasing people for money is awkward. New fintech platforms allow for “Shared Spaces” where everyone in the group can contribute to a digital pot. The funds can then be spent directly from a shared virtual card, eliminating the “you owe me $10” texts that never get answered.

Conclusion: Future-Proofing Your Degree

The PhD or MBA journey is a marathon, not a sprint. The tools you choose at the beginning will determine how much energy you have at the finish line. By integrating fintech like virtual cards and privacy-focused payment methods into your routine, you remove the “financial noise” that clutters the mind of a researcher.

Don’t wait until you’re staring at a “transaction declined” message or a suspicious charge on your bank statement to upgrade your kit. Start by separating your “academic life” from your “personal life” at the banking level. Your future self—the one wearing the graduation gown—will thank you for the peace of mind you built today.

Frequently Asked Questions

1. How do virtual payment tools improve financial security for researchers?

Virtual payment methods act as a digital shield by providing unique, temporary credentials for every transaction. This prevents your primary bank details from being exposed to third-party databases, significantly reducing the risk of identity theft or unauthorized recurring charges on your main account.

2. Can these digital tools help manage international research costs?

Yes. Modern fintech solutions allow students to hold and spend in multiple currencies, often bypassing the steep foreign exchange fees charged by traditional banks. They are particularly effective for one-off payments to global archives, specialized tools, or international academic support platforms.

3. What are the benefits of using disposable cards for academic subscriptions?

Disposable cards allow you to set strict spending limits and automatic expiration dates. This is ideal for managing short-term trials or monthly research subscriptions, as it prevents “subscription creep” where forgotten services continue to drain your budget after your project is complete.

4. Are these financial tools difficult for students to set up?

Most contemporary digital banking and payment platforms are designed for instant setup. Students can typically generate a secure, functional payment method within minutes via a mobile app, requiring only basic verification and no physical paperwork or long waiting periods at a bank branch.

About The Author

Harrison Walker is a digital strategist and lead contributor at MyAssignmentHelp, specializing in the intersection of educational technology and modern student lifestyles. With a focus on digital security and academic efficiency, Harrison explores how emerging tools help postgraduate researchers navigate the complexities of higher education in a digital-first world.